Economic Review – July 2025

| UK economic output shrank for the second month in May, driven by weakness in manufacturing and construction | Inflation rose unexpectedly to 3.6% in June, complicating the Bank of England’s rate-cut considerations | Labour market shows signs of cooling, with falling vacancies and slowing wage growth amid economic uncertainty |

UK economy still struggling to expand

Figures published last month by the Office for National Statistics (ONS) showed the UK economy unexpectedly shrank in May, while more recent survey evidence suggests output remained lacklustre at the start of the third quarter.

According to the latest official statistics, economic output fell by 0.1% in May, a second successive monthly decline following April’s 0.3% contraction. This disappointing performance, which was driven by a drop in output across the manufacturing and construction sectors, defied analysts’ expectations for a small monthly expansion.

The data did though show that the economy grew by 0.5% across the three months to May. ONS noted that the second quarter as a whole will still see some growth if June’s monthly reading is flat or better and the previous two months’ figures are not revised downwards. However, while most economists are not forecasting a second-quarter contraction, they are now predicting a weaker growth profile than previously envisaged for the April–June period.

Preliminary figures from the latest S&P Global UK Purchasing Managers’ Index (PMI) also point to relatively sluggish growth in July, with its headline growth indicator falling to 51.0 last month. While this leaves the index above the 50.0 threshold denoting growth in private sector output, it does imply a relatively weak growth trajectory, which S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said reflected both domestic headwinds linked to “the ongoing impact of policy changes announced in last autumn’s Budget” and “the broader destabilising effect of geopolitical uncertainty.”

Mr Williamson added, “The flash UK PMI survey for July shows the economy struggling to expand as we move into the second half of the year. Output growth weakened to a pace indicative of the economy growing at a mere 0.1% quarterly rate, with risks tilted to the downside in the coming months.”

Surprise rise in headline inflation rate

Although the latest set of consumer price statistics did reveal an unexpected jump in UK inflation, economists still typically expect Bank of England (BoE) policymakers to sanction another interest rate cut after their next scheduled meeting during the first week of August.

Data released last month by ONS showed the Consumer Prices Index (CPI) 12-month rate – which compares prices in the current month with the same period a year earlier – rose to 3.6% in June. This was up from 3.4% the previous month and left the headline inflation rate at its highest level since January 2024.

ONS noted that the increase was primarily driven by higher transport costs, particularly in relation to motor fuel, air fares and train tickets. Other notable upward contributions came from both the food and non-alcoholic drink sector, which recorded its largest rise in prices since February 2024, and the clothing and footwear sector.

This latest increase in price pressures will undoubtedly create a dilemma for policymakers when the BoE’s Monetary Policy Committee (MPC) convenes for its August meeting. Last month, however, Bank Governor Andrew Bailey did reiterate his belief that the path of interest rates remains downwards, adding that the Bank was prepared to make larger cuts if the jobs market shows signs of slowing down.

Despite last month’s inflation surprise, most analysts expect that recent weak economic growth data and signs of a cooling labour market will persuade the BoE to cut rates this month. Indeed, a recent Reuters survey found that over 80% of economists think the Bank will sanction two more quarter-point reductions this year, which would leave Bank Rate at 3.75% by the end of December. And the MPC is widely expected to announce the first of those cuts after its next meeting on 7 August.

Markets

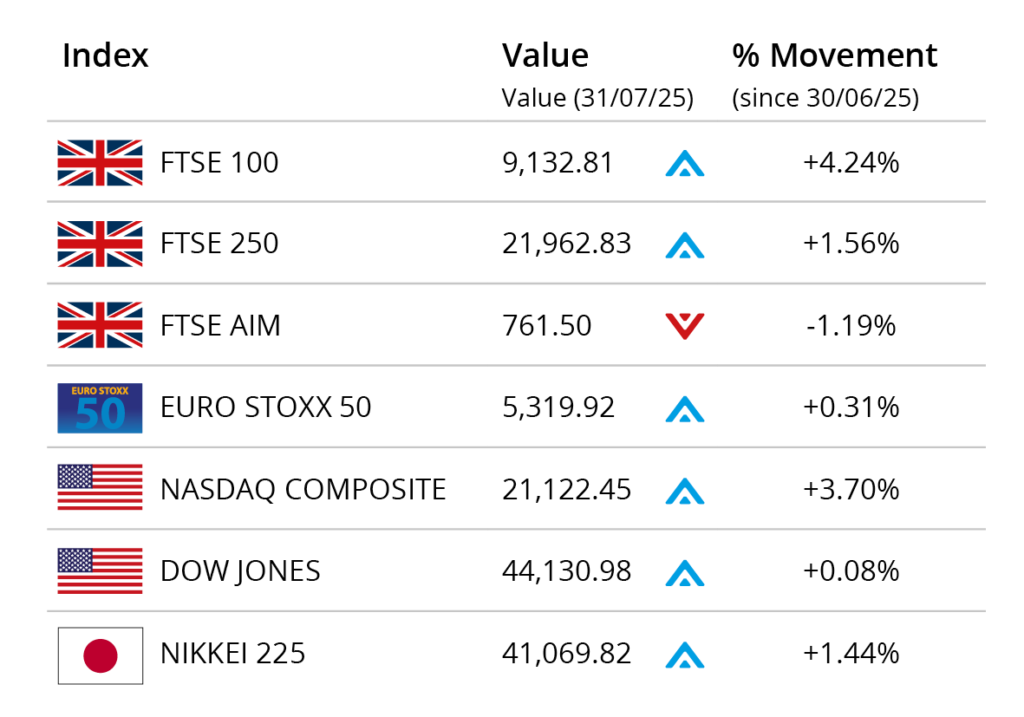

Global markets posted mixed results in July as investors weighed inflation data, interest rate policy and geopolitical developments.

In the UK, the FTSE 100 made headlines mid-month by breaking through the 9,000 barrier for the first time, closing July on 9,132.81, a gain of 4.24%. This performance was driven in part by strong earnings in the banking and mining sectors. The mid-cap FTSE 250 also rose, up 1.56% to 21,962.83, while the smaller-cap FTSE AIM slipped by 1.19% to end July on 761.50.

The US Federal Reserve held interest rates steady in a 92 vote, at a range of 4.25% – 4.50% at its July meeting, with two governors dissenting and signaling caution amid easing growth and persistent inflation risks. The Dow Jones closed July on 44,130.98, a minimal rise of 0.08% in the month, while the tech-orientated NASDAQ closed the month up 3.70% on 21,122.45.

European equities were muted, with the Euro Stoxx 50 rising just 0.31% to 5,319.92. In Asia, Japan’s Nikkei 225 gained 1.44% to close the month at 41,069.82.

On the foreign exchanges, the euro closed the month at €1.15 against sterling. The US dollar closed at $1.32 against sterling and at $1.14 against the euro.

On the commodities front, Brent Crude closed July at around $71 a barrel, registering a near 6% monthly gain. However, oil prices dipped toward month-end amid uncertainty surrounding US trade policy and expectations of increased output from OPEC+. Gold prices climbed 1.26% over the month, finishing near $3,347 per troy ounce.

More signs of cooling in the jobs market

The latest batch of labour market data revealed fresh evidence of a softening in the UK jobs market with pay growth slowing, employee numbers down and a further fall in the overall level of job vacancies.

ONS statistics released last month showed that the number of payrolled employees dropped by a provisional 41,000 in June following a 25,000 decline in May. There was also another fall in the estimated number of job vacancies, with 56,000 fewer reported in the April–June period compared to the previous three months; this took vacancies down to a 10-year low, excluding the plunge witnessed during the pandemic.

The data release also revealed a slowdown in wage growth with average weekly earnings, excluding bonuses, rising at an annual rate of 5.0% in the three months to May, down from 5.3% in the previous three-month period. This represents the slowest rate of pay growth since the second quarter of 2022.

Survey evidence also points to a more recent cooling. The latest KPMG and REC jobs survey, for instance, recorded the sharpest increase in the number of people available for work since the pandemic, while last month’s PMI data showed staffing numbers are now decreasing at the fastest rate since February.

Summer sunshine boosts retail sales

Last month’s official retail sales statistics revealed a partial rebound in sales volumes during June, although the rate of growth was lower than most economists had been expecting.

The latest ONS figures showed that retail sales volumes grew by 0.9% in June. While this does represent a bounce back from May’s downwardly revised plunge of 2.8%, the rise did come in below analysts’ expectations with the consensus forecast from a Reuters poll of economists predicting an increase of 1.2%.

ONS Senior Statistician Hannah Finselbach said the warm weather in June had helped boost sales, with supermarkets reporting “stronger trading and an increase in drink purchases”, while fuel sales were also up as “consumers ventured out and about in the sunshine.” Ms Finselbach did, however, add, “Looking at broader trends, retail sales are up slightly across the latest quarter but are down when compared with pre-pandemic levels.”

Evidence from the latest CBI Distributive Trades Survey also suggests that sales volumes may have struggled in July with retailers noting that ‘elevated price pressures’ and ‘economic uncertainty’ continued to weigh on household demand. The survey also found that retailers expect sales volumes to fall short of seasonal norms in August as well.

All details are correct at the time of writing (01 August 2025)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.